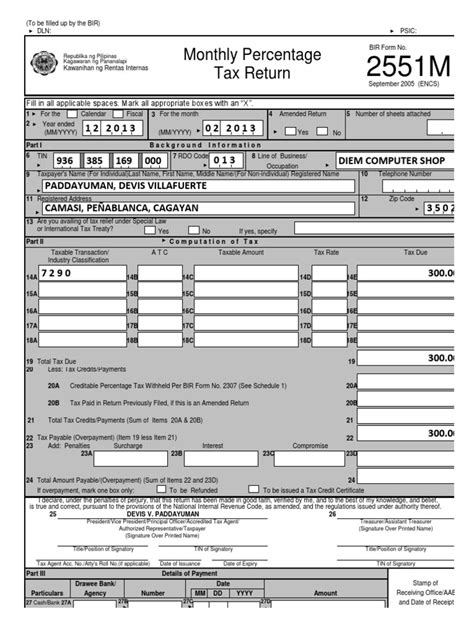

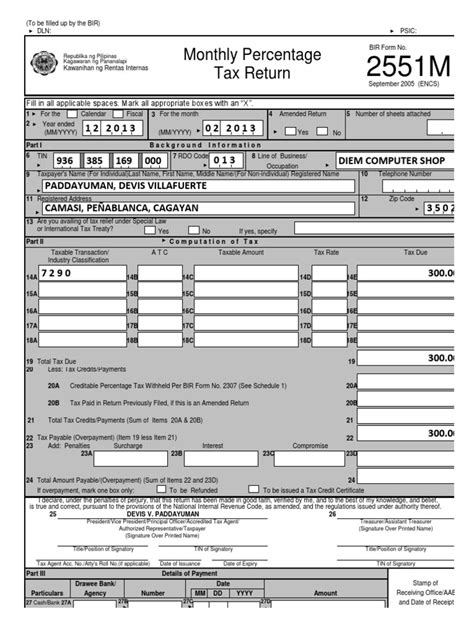

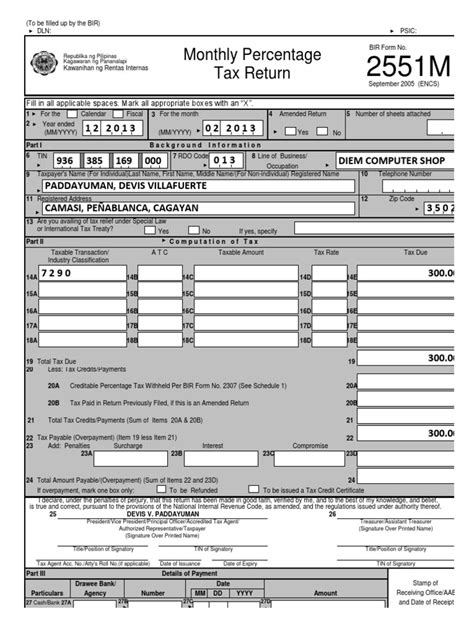

2551m bir form|BIR Form No. 2551M Monthly Percentage Tax Return : Bacolod BIR Form No. 2551M | Download Free PDF | Taxes - Scribd

Hentai City has free HD hentai porn videos, hot anime sex, naughty cartoon XXX and 3D hardcore movies. Tons of adult comics, doujinshi and manga to read.

2551m bir form,General Requirements. Letter-request. Application Form duly signed by the nonresident income recipient or its/his/her authorized representative. Tax Residency Certificate .Where the return is filed with an AAB, taxpayer must accomplish and submit .In place where there are no AABs, payment shall be made directly to the Revenue .

BIR Form No. 2551m Filing Help. 1. Familiarization of the form. a. Entry .Learn how to file and pay the percentage tax on gross sales, receipts or earnings for certain businesses and activities in the Philippines. Find out the tax rates, exemptions, penalties .

BIR Form No. 2551M | Download Free PDF | Taxes - ScribdBIR Form No. 2551M Monthly Percentage Tax ReturnBIR Form 2551M Help Page - eFPS

BIR Form No. 2551 - Guidelines and Instructions - eFPS

Download and fill out this form if you are a VAT-registered person or a non-VAT-registered person with certain income or business activities. Learn how to compute your taxable .14 rows — In place where there are no AABs, payment shall be made directly to the .BIR Form No. 2551m Filing Help. 1. Familiarization of the form. a. Entry Fields. These colored white text fields or option buttons are used to enter data. b. Display Fields. .

Learn the steps and procedures in accomplishing the BIR Form No. 2551M, a quarterly percentage tax return for certain industries. Use the eFPS web-based application to .

Download and fill out the PDF form for monthly percentage tax return for individuals or non-individuals. See the instructions, tax rates, industry classifications, and computation of .BIR Form 2551M is a tax return for persons who are not VAT-registered and who are subject to percentage taxes on their gross receipts. It covers various types of .BIR Form No. 2551M - Free download as PDF File (.pdf), Text File (.txt) or view presentation slides online. This document is a monthly percentage tax return form for .Receipt BIR Form No. 2524) therefor. Where the return is filed with an AAB, taxpayer must accomplish and submit BIR-prescribed deposit slip, which the bank teller shall machine .BIR Form 2551M - Free download as Excel Spreadsheet (.xls), PDF File (.pdf), Text File (.txt) or read online for free. This document is a percentage tax return form submitted to the Bureau of Internal Revenue of the Philippines. It contains information about the taxpayer such as their name, address, tax identification number, and line of business.

Abr 10, 2015 — Step 7: Complete your BIR Form. Your BIR form will now load, and your details will automatically be filled in the form. You should now complete the required data on each section. Choose the date .

BIR Form 2551M is a Monthly Value-Added Tax Declaration Form used by businesses to report and remit Value-Added Tax (VAT) to the Bureau of Internal Revenue (BIR). The form is used to declare the total amount of .2551m bir form BIR Form No. 2551M Monthly Percentage Tax ReturnJust a side note, since 2015, it has been encouraged to do electronic preparation of BIR Forms using eBIRFORM. But nonetheless, here’s a quick guide on how to prepare the BIR Form 2551Q manually: Page 1 of the BIR Form 2551Q: Part I of BIR Form 2551Q asks for basic information about you or your business—TIN, Name, Address, Contact Details, etc.The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .Abr 27, 2018 — BIR Form 2551Q (Quarterly Percentage Tax Return) Under the TRAIN Law, VAT-exempt taxpayers with annual revenues not exceeding P3M must file their percentage tax on a quarterly basis.For this, you have to accomplish the BIR Form 2551Q, which means the Form 2551M is out of the picture. What do I have to do after securing the .

2551, 2551M, 2552 and 2553 o Help>> Value Added Tax – consists of help file for BIR Form No. 2550M and 2550Q o Help>> Withholding – consists of help file . Learn more Try more PDF tools

BIR Form No. 2551M Monthly Percentage Tax ReturnBIR Form No. 2551M - Free download as PDF File (.pdf), Text File (.txt) or view presentation slides online. This document is a monthly percentage tax return form for the Bureau of Internal Revenue of the Philippines. It provides instructions for taxpayers to report their tax liability for a given year or fiscal period. The form includes sections to input .

Under Republic Act No. 10963, also known as the Tax Reform for Acceleration and Inclusion (also known as TRAIN Law), 2551Q forms shall be filed every 25th day after the taxable quarter.. Please take note that your tax forms will be sent electronically to the BIR until 9pm. Any forms that will be sent beyond that filing deadline will be transmitted .

BIR Form 2551M – Fill Out and Use This PDF. The BIR Form 2551M is a monthly percentage tax return that needs to be filled out by certain businesses and individuals in the Philippines. This includes those whose annual gross sales and/or receipts do not exceed P1,500,000 and who are not VAT-registered, among others.While the Guidelines and Instructions link opens up another window that will show you the Guidelines and Instructions and the Tax Table of Form 2551. Help link brings you to this page. *Note : Form fields may look and act differently on other browsers. 2. Navigating through the form: a.The Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .

This document provides guidelines and instructions for filing BIR Form No. 2551M Percentage Tax Return. It outlines who must file the return, including those with gross annual sales under 1.5 million pesos. It details when and where the return and tax payment are due, generally within 20 days of the end of each month. The basis of the tax is gross .Okt 9, 2023 — There is no need to file and pay monthly percentage tax on their monthly gross receipts using BIR Form No. 2551M.” . BIR Form No. 1700: Annual Income Tax Return for Individuals Earning Purely Compensation Income. This return is filed annually by every resident citizen deriving compensation income from all sources, or resident alien .Form 2551M: Monthly Percentage Tax Return: Form 2552: . Changes should be done through BIR Form 1905 and the same should be filed with the Large Taxpayers Assistance Division (LTAD) / Large Taxpayers District Office (LTDO) or at the Revenue District Office (RDO) where you are registered. .2551m bir formThe Bureau of Internal Revenue (BIR) site (www.bir.gov.ph) is a transaction hub where the taxpaying public can conveniently access anytime, anywhere updated information on the Philippine tax laws and their implementing regulations and revenue issuances, including information on BIR Programs and Projects. It also contains copy of the Tax Code, BIR .

Dis 3, 2017 — Learn how to Fill and print BIR form 2551M for 2017 - 2018 updatedThis Video will show step by step how to fill up 2551M for Non-vatAccounting and Bookkeepin.(Item 20A "Creditable Percentage Tax Withheld Per BIR Form No. 2307") 13. If amended return, indicate the amount of tax paid in the previously filed tax return. . If the form was successfully Validated by the system, check the outcome of the validation by observing the following computed fields in item nos.: 14E-18E, 19, 20C, 21, 22D and 23. .

2551m bir form|BIR Form No. 2551M Monthly Percentage Tax Return

PH0 · Procedures in accomplishing BIR Form No. 2551M

PH1 · DLN: PSIC: Monthly Percentage 2551M Tax Return

PH2 · DLN: PSIC: Monthly Percentage 2551M Tax Return

PH3 · DLN: PSIC: Monthly Percentage 2551M

PH4 · BIR Form No. 2551M Monthly Percentage Tax Return

PH5 · BIR Form No. 2551M

PH6 · BIR Form No. 2551

PH7 · BIR Form 2551M Help Page

PH8 · Application Form)